Seeking Financial Assistance for a Commercial Fire? Here's How To File A Fire Claim

6/18/2021 (Permalink)

Here's How To File A Fire Claim

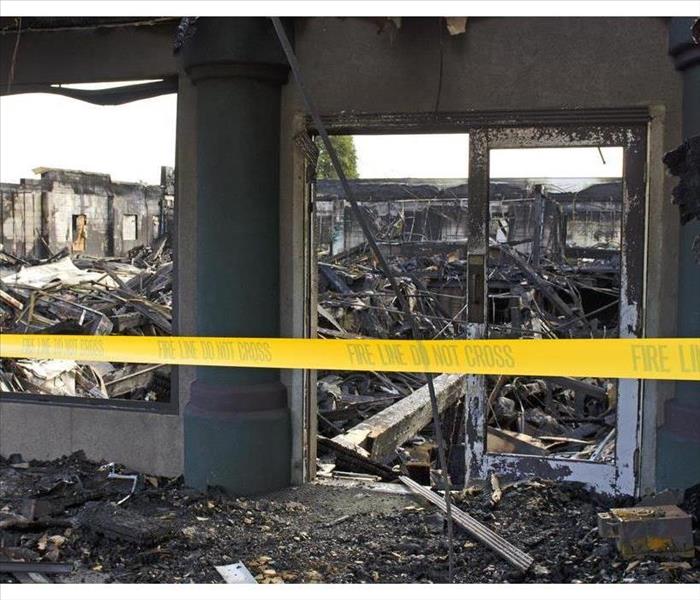

Sparks start small, but those tiny embers can cause severe devastation. Commercial owners in Van Nuys South, CA, are likely to face high bills during restoration efforts. Owners rarely have ten to twenty thousand dollars set aside for repairs. By filing a fire claim with your insurance company, proprietors can seek coverage to alleviate the burden.

1. Seek Help ASAP

Insurers have two purposes: to assist clients and to evaluate the accuracy of claims. It's imperative to seek compensation quickly, showing good faith and solid effort. Be clear about the date and time for the fire. Provide report information, and ask about insurance policies for how to proceed.

2. Focus on Mitigating Secondary Conditions

Don't wait for a check to arrive in the mail. Your agent appreciates proactive approaches that keep the overall costs low. Your property demands immediate action to prevent additional damage. Work with a fire restoration company to mitigate further concerns and secure the location. The team should begin assessing moisture problems, working to avoid mold development. They may also tear out structural pieces that pose a hazard.

3. Secure the Facility

The agency desires responsibility. This goes a long way to backing your fire claim. Safeguard the building. The fire burnt holes in the walls and ceiling. These should be tarped and boarded up to avoid unwanted visitors. Animals and humans often find fire-ravaged spaces intriguing. Trespassers are a significant issue. If someone gets hurt, the injured party could sue.

3. Create an Effective Organizational System

The next few months are going to be busy, and the paperwork is going to build. Maintain clear communication with the insurance company and provide thorough documentation of fire damage. Think about how you plan to store receipts and photos.

Capture images of everything, and write out an inventory list of anything replaced. Share records for lost income as well as the price of temporarily relocating. Some policies offer help in these areas too.

A fire claim is a lifeline for many business owners, creating an opportunity to rise from the ashes and begin again without having to face expensive loans and long-time bills. Be sure to get organized and document as much as possible.

24/7 Emergency Service

24/7 Emergency Service